Klarna And Clear Pay

Buy Now and Pay Later with Klarna And Clear Pay

See something you like on Buy Insulation Online, but don't have the budget yet? Not to worry, Buy Insualtion Online brings you Staggered Payment oprions deom Klarna and Clear pay. You can pay in 3-4 easy, interest-free instalments for the product you like, that too interest-free!

You can choose to spread the payments over 3-4 easy, interest-free instalments or with the Buy Now and Pay later option of 30 days with Klarna. No additional fee or interest will be charged on instalments, provided they are paid on time. T&C’s Apply.

It just got so easy to Buy Insulation Online!

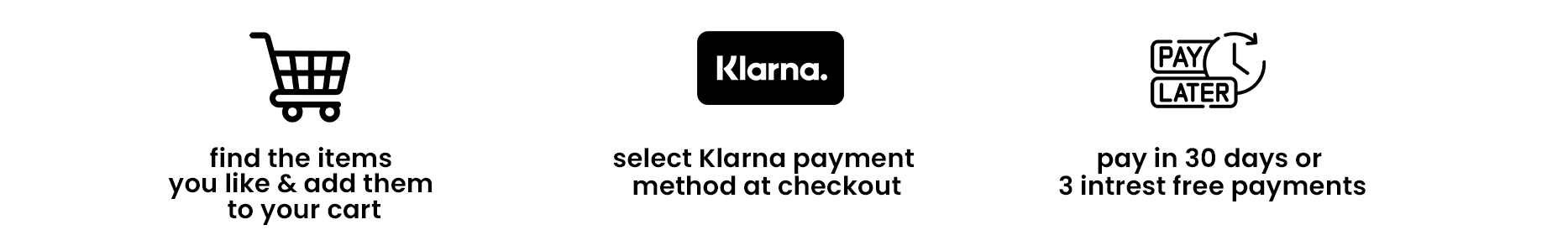

Klarna

Here’s how it works:

Step 1: Add products to your cart and select “Klarna” when you check out

Step 2: You will be asked to log in to your Klarna account or create an account if you do not have one already. Enter a few personal details and you’ll know instantly if you’re approved. If approved, after selecting the repayment plan of your choice, checkout securely. You will be redirected to our website.

Step 3: Klarna will send you an email confirmation and reminders when it’s time to pay and you can manage your orders and payments in the Klarna app.

Payments information

1. Pay in 3 - Split your purchases into 3 interest-free payments

Spread the cost of your purchase into 3 interest-free instalments. The first payment is made at point of purchase, with remaining instalments scheduled automatically every 30 days. Select the Klarna option and enter your debit or credit card information.

- A new way to pay that's an alternative to a credit card.

- 3 instalments give you flexibility to shop without interest.

- Not making your payment on time could affect your ability to use Klarna in the future.

- Debt collection agencies are used as a last resort.

Klarna's Pay in 3 is an unregulated credit agreement. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status.Ts&Cs and late fees apply. [www.klarna.com/uk/terms-and-conditions]

2. Pay in 30 days - Shop now. Pay in 30 days with Klarna

Pay up to 30 days later. No interest. No fees, when you pay on time.

- Complete the payment in full after purchase at no added cost.

- The report returns directly in the Klarna app and only pay for the items that you keep.

- Not making your payment on time could affect your ability to use Klarna in the future.

- Debt collection agencies are used as a last resort

Pay in 30 days is an unregulated credit agreement. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status.Ts&Cs and late fees apply. [www.klarna.com/uk/terms-and-conditions]

About Klarna: Pay online or in the app

Review your latest purchases and make payments in the Klarna app or online. Useful Links:

- Download the Klarna app: https://www.klarna.com/app

- Log in online: https://app.klarna.com/login.

- Chat with customer service: https://www.klarna.com/uk/customer-service/

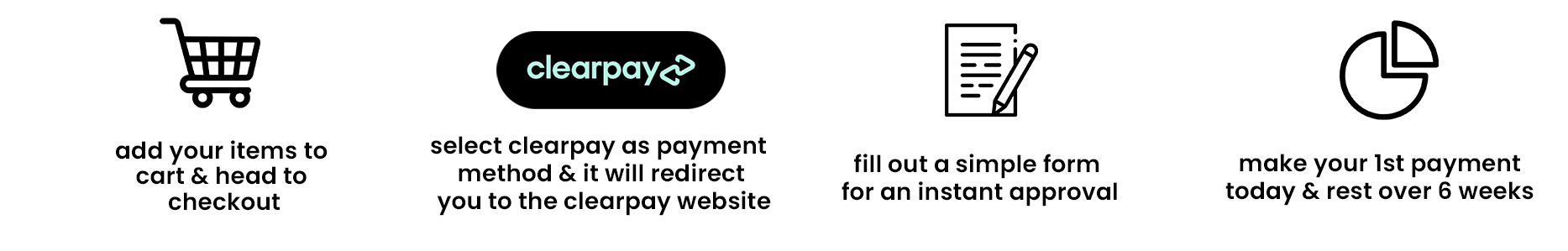

Clear Pay

Clear pay offers you the option to Shop now and pay later in 4 interest-free installments over six weeks. Furthermore, you also win a chance to earn rewards when you pay on time. Do it all in the app, easily and securely.

Here’s how it works:

Step 1: You will need to create a Clear Pay for these transactions. Get the Clear Pay app, sign up. There are no long applications. You only need your email, phone number, address, DOB and debit/credit card handy to open an account

Click to get the Clear Pay ap.

Step 2: Once the account is set (or if you already have one), choose Clearpay at checkout. Choose a payment method for the installment payments (e.g., credit or debit or other payment card or method accepted by us such as Apple Pay) and pay in 4 interest-free installments - make your first payment today(on the day of the purchase) and the rest over 6 weeks.

Step 3: Pay the installments on Time: No fees when you pay on time. Clear Pay will send you reminders and cap late payments to help you get back on track. You can further track your payments on the Clear pay app

Unlike Klarna, Clear pay does not offer you the option to pay in 30 days. It simple splits your purchase to 4 small installments, that can be paid over the course of 6 weeks.

Terms And Conditions For ClearPay:

- To register for an account and be eligible to use Clear Pay services, you must be a UK resident (excluding Channel Islands), aged 18 or over, have a UK payment method.

- When your account is created, you will be asked to set up a username and secure password. We/Clear Pay are not responsible for any unauthorised use or access of your account unless Clear Pay have failed to take reasonable steps to prevent such unauthorised use or access. Contact Clear Pay immediately if you notice any unauthorised access or use of your account.

Know more about the Terms And Conditions For ClearPay

Frequently Asked Questions:

Who is Klarna?

Klarna is a payment service that helps you buy the things you want or need. Right now, over 150 million people worldwide use Klarna at over 450,000 online stores.

How does Pay Later in 30 days work?

Pay in 30 days is a credit product which lets you pay any time within 30 days of your purchase interest-free. You can make this payment using a credit or debit card on the Klarna app or logging into Klarna Website. Klarna will send you a confirmation email once your order is confirmed with full details. You can see both past and future payments using the Klarna app.

Am I eligible for Pay in 30 days?

You need to be at least 18 years old and a UK resident to use Klarna’s credit products including Pay in 30 days. When you choose Klarna they will also check the information you provide and your financial situation.

What do I need to provide when I make a purchase?

If you want to purchase something using Klarna’s Pay in 30 days, you'll need to share your phone number, email address, current billing address and your credit or debit card details. If Klarna need to talk to you urgently they'll use the phone number you've shared. For any other information, Klarna needs to share with you, they'll send this to your email address.

Will a credit search take place?

When you use Pay in 30 days, Klarna will perform a credit search. This means Klarna will look at certain information in your credit report to decide whether to approve your purchase.

How do I make repayments to Klarna?

You can pay any time within 30 days of your purchase interest-free. You can make this payment using a credit or debit card on the Klarna app or logging into Klarna Website. Klarna will send you a confirmation email once your order is confirmed with full details. You can see both past and future payments using the Klarna app.

I have been asked to go to the Klarna site. Is this correct?

If you choose to pay for your order using Pay in 30 days, Klarna will send you an email showing you how to pay. The email will have a link you can use to make this payment using your credit or debit card.

Can I pay before the due date?

Yes. Just go to the Klarna app or log onto https://www.klarna.com/uk/

Is my payment information safe?

Payment information is processed securely by Klarna and Clear pay. No card details are transferred to or held by Chase Insulations Ltd. All transactions take place through connections secured with the latest industry-standard security protocols.

How do I know Klarna/Clear Pay has received my payment?

Klarna/Clear Pay will notify you by email and push notification when a payment is due and when you have made or missed a payment. You can always check the status of your order and payments in the respective apps.

What happens if I don’t make a payment on time?

Pay in 30 days is a credit product and you are required to make your payment to Klarna. If you don't pay for your order on time, Klarna may charge late payment fees. Klarna may also share information about your missed payments with credit reference agencies. This means you may find it difficult or more expensive to use Klarna or other lenders' credit products in the future. Full details can be found in the Klarna terms and conditions here.

I've received a statement, but I've not yet received my goods.

If you have not received your goods please call Chase Insulations Ltd (T/N Buy Insulation Online) to check on your order and delivery status. You can also contact Klarna’s Customer Service so that they can postpone the due date on your payment or put the order on hold in the Klarna app while you wait for the goods to arrive.

What happens if I cancel or return my order?

As soon as Chase Insulations Ltd (T/N Buy Insulation Online) has confirmed with Klarna that your cancellation / return has been accepted, Klarna will cancel any future scheduled payments as well as refund any amounts due. You will see the return in the Klarna app immediately.

Please note, custom made products (like metal cladding, valve covers) and products coming to you directly from the manufacturer are not eligible for returns/refunds), Such products are indicated on the Product page

How Do I cancel my order, Paid For via Klarna?

If you wish to cancel an order, paid for via Klarna, please put in a cancel request with us via email, call or online chat. Once your cancellation request is processed, we will intiate your refund.

Upon us initating the refund, Klarna will be made aware of the cancellation and the refund will normally be processed within 7-14 business days. Refunds will be issued back to the debit or credit card which was originally used at checkout.

How Do I return My Order, Paid For via Klarna?

If you wish to return an order, paid for via Klarna, please put in a return request with us via email, call or online chat. If the product can be returned, we will instruct the process that needs to be followed. Once your return request is processed, let Klarna know which items you have returned by reporting a return in the Klana app:

- Go to Purchases

- Select the order, or the items, you wish to return

- Tap Report return

For any more information, please visit Klarna app Klarna’s Customer Service page.

Can I repay a Clearpay Plan early?

You have the right to repay a Clearpay Plan early in part or full at any time through your account on our website or app.

Does Clear Pay Charge Interest?

Clearpay Plans are interest free. However, your bank may charge interest or other charges in accordance with the terms and conditions of the agreement between you and your bank.

Does Clear Pay Charge Late Fee?

Clear Pay only charges late fees if you do not pay on time. The late fees charged are:

• Orders less than £24: Clear Pay may charge one late fee of £6 if you do not pay an installment under a Clearpay Plan by the due date.

• Orders equal to or more than £24: Clear Pay may charge a late fee of £6 if you do not pay an installment under a Clearpay Plan by the due date and a second late fee of £6 if the installment is still unpaid 7 days after the due date. The total late fees that may be applied to an Order are capped at 25% of the purchase price of the Order (before any refunds are applied) or £24, whichever is less.

All late fees are payable by you at once. Late fees will not be applied until the date after the day that payment is due. You authorise Clear Pay to deduct payment from your payment method for any late fees when they are due.

How do I request a refund for order placed via Clear Pay option?

If you want to return goods to us (buy Insulation Online) and request a refund, you need to contact us via email, call or online chat and arrange the return and refund according to our terms and conditions and policies. You can notify Clearpay of a return to stop payments and avoid a late payment fee

Please note, custom made products (like metal cladding, valve covers) and products coming to you directly from the manufacturer are not eligible for returns/refunds), Such products are indicated on the Product pages